A Comprehensive Guide to Compliance, Performance, and Strategic Sustainability

Climate change has prompted governments, corporations, and cities to adopt robust methods for measuring and reducing greenhouse gas (GHG) emissions. Carbon accounting (or GHG accounting) is the framework of methods used to quantify emissions from organizational activities and projects. With evolving regulatory requirements and market pressures, understanding and implementing standardized carbon accounting frameworks is essential for effective compliance and strategic decision-making. This guide reviews key frameworks, discusses inherent challenges, highlights current trends, and presents actionable, AI-driven strategies for enhanced compliance and performance.

1. Carbon Accounting Fundamentals

Carbon accounting enables organizations to establish baselines, set reduction targets, and track progress transparently. It provides the foundation for sustainability initiatives, supports regulatory compliance, informs investors about climate risks, and helps optimize operational efficiency.

Why It Matters

-

Environmental Stewardship:

Accurate carbon accounting drives measurable GHG reductions and supports global climate goals (IPCC, 2021). -

Regulatory Compliance:

Many countries mandate GHG reporting; for example, the U.S. EPA’s Greenhouse Gas Reporting Program requires detailed facility-level data (US EPA, 2022). -

Investor Confidence:

Frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) help investors assess climate-related risks and opportunities. -

Operational Efficiency and Cost Savings:

Detailed emissions data can reveal inefficiencies and drive energy-saving initiatives, as shown by studies linking robust reporting with reduced operational costs (Corporate Finance Institute, 2023).

2. Evolution and Origins of Carbon Accounting

The evolution of carbon accounting reflects decades of international collaboration and policy development. Early efforts were national in scope, but global agreements have driven the adoption of standardized frameworks.

Historical Milestones

-

1995 – National Reporting:

Developed countries began reporting emissions from key industrial sectors under the UN climate program (UNFCCC, n.d.). -

1997 – Kyoto Protocol:

Established binding emissions targets for developed nations and defined the key GHGs, setting the stage for modern carbon accounting (UNFCCC Kyoto Protocol). -

2001 – GHG Protocol:

The World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD) introduced the first version of the Greenhouse Gas Protocol. This framework has since become the most widely adopted standard (GHG Protocol, 2023). -

2002 – Carbon Disclosure Project (CDP):

Initiated in the UK, CDP expanded global corporate participation in GHG reporting (CDP, 2022). -

2015 – Paris Agreement & TCFD:

Following the Paris Agreement, frameworks like TCFD emerged to help companies disclose climate risks and set science-based targets (TCFD, 2017). -

Recent Developments:

Initiatives such as the Science Based Targets initiative (SBTi) and evolving regulations in the EU and U.S. have further driven harmonization and transparency in carbon accounting.

These milestones have transformed carbon accounting into a global best practice for sustainability reporting.

3. Drivers Behind GHG Reporting

GHG reporting is driven by both internal motivations and external requirements, which together compel organizations to adopt robust carbon accounting practices.

Internal Drivers

-

Risk Management and Efficiency:

Companies use GHG data to identify inefficiencies and reduce energy costs. For instance, predictive analytics can preempt equipment failures, reducing both downtime and emissions (McKinsey, 2020). -

Competitive Benchmarking:

Public rankings based on emissions performance motivate companies to report transparently. -

Investor Demand:

Investors increasingly rely on GHG disclosures to assess long-term risk. Frameworks like TCFD have become key in financial due diligence. -

Corporate Strategy:

Integrating carbon accounting supports net zero commitments and long-term sustainability goals.

External Drivers

-

Regulatory Mandates:

Governments around the world enforce GHG reporting through programs like the US EPA’s GHGRP and the EU’s Corporate Sustainability Reporting Directive (CSRD). -

Market Mechanisms:

Cap-and-trade systems and carbon offset markets require precise emissions data for their functioning. -

NGO and Voluntary Programs:

Initiatives such as CDP and SBTi encourage voluntary disclosure, improving transparency and accountability across industries. -

International Agreements:

Global accords, like the Paris Agreement, have increased the need for harmonized and accurate emissions reporting.

4. Frameworks and Standards in Carbon Accounting

A wide range of frameworks guide the measurement and reporting of GHG emissions. These frameworks ensure consistency, transparency, and comparability across different sectors and regions.

4.1 Greenhouse Gas Protocol (GHG Protocol)

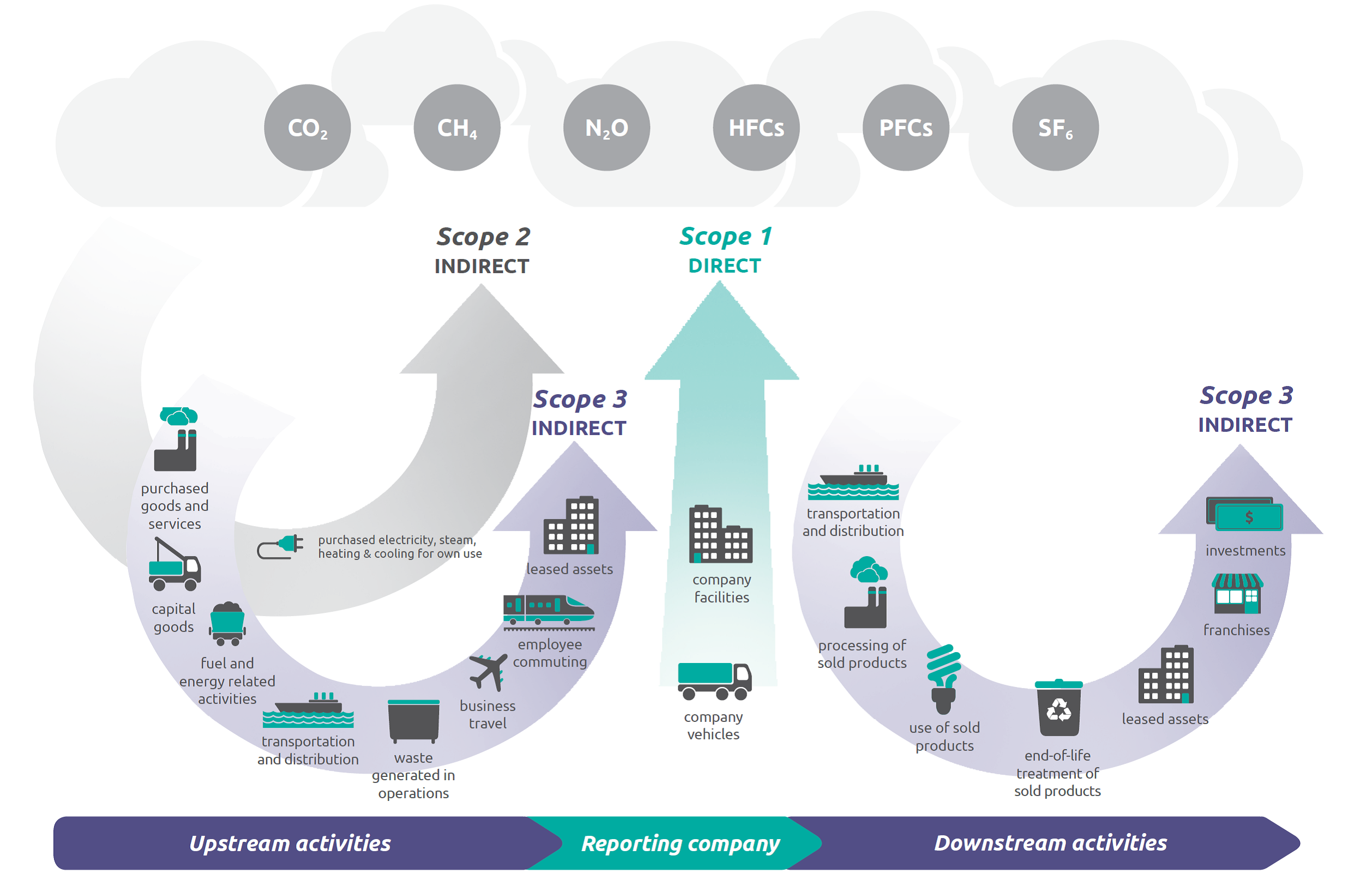

The GHG Protocol is the most widely adopted standard for carbon accounting. It categorizes emissions into three scopes:

-

Scope 1: Direct emissions from owned or controlled sources.

-

Scope 2: Indirect emissions from purchased energy.

-

Scope 3: All other indirect emissions, including those from the value chain.

It supports both attributional and consequential accounting methods. Detailed guidance is available on the GHG Protocol website.

4.2 ISO 14064

ISO 14064 provides internationally recognized standards for quantifying and reporting GHG emissions:

-

ISO 14064-1: Sets out requirements for emission quantification and reporting.

-

ISO 14064-3: Offers guidance for the validation and verification of GHG data.

More detailed information is available on the ISO website.

4.3 PAS 2060

PAS 2060 is a standard for demonstrating carbon neutrality. It requires organizations to include all Scope 1, Scope 2, and significant Scope 3 emissions in their accounting and to develop a comprehensive Carbon Management Plan outlining reduction targets and offset strategies. Visit the British Standards Institution for further details.

4.4 EPA Greenhouse Gas Reporting Program (GHGRP)

The US EPA’s GHGRP mandates facility-level and supplier-based reporting for multiple industrial sectors, employing advanced methodologies to ensure data accuracy.

4.5 Task Force on Climate-related Financial Disclosures (TCFD)

TCFD provides recommendations for companies to disclose climate-related risks and opportunities in governance, strategy, risk management, and metrics. It emphasizes comprehensive reporting of Scope 1 and Scope 2 emissions, with material Scope 3 emissions included where relevant. More information is available on the TCFD website.

4.6 Protocols for Cities and Communities

Urban areas use specialized protocols to inventory GHG emissions. The Global Protocol for Community-Scale Greenhouse Gas Inventories and the ICLEI U.S. Community Protocol guide local governments in defining boundaries, reporting by sector, and driving climate action.

4.7 Product and Project Accounting Standards

-

Product Accounting:

Standards like ISO 14067 and PAS 2050 enable organizations to assess the carbon footprint of products throughout their life cycle. -

Project Accounting:

ISO 14064 Part 2 and specific GHG Protocol guidelines verify the emissions reductions of individual projects. Certification programs such as the Verified Carbon Standard (VERRA) and Gold Standard provide additional assurance.

5. Limitations of GHG Accounting

While carbon accounting is crucial for driving sustainability, several challenges can compromise the accuracy and comparability of emissions data.

5.1 Defining Organizational Boundaries

Determining which operations to include in an emissions inventory can be subjective. Multinational companies, for instance, may differ in whether they include emissions from outsourced activities.

Reference: Detailed discussions on organizational boundaries can be found in the GHG Protocol Corporate Accounting Guidance.

5.2 Uncertainty in Emission Estimates

Emission estimates depend on assumptions and default factors that may not capture site-specific conditions. This can lead to errors in total emissions calculations.

Action: Implement continuous monitoring and advanced analytics to reduce uncertainty.

5.3 Incomplete Scope 3 Reporting

Scope 3 emissions, often the largest portion of an organization’s footprint, are difficult to measure due to inconsistent data from suppliers and other indirect sources. Research indicates that many companies under-report these emissions (CDP, 2019).

Action: Collaborate with supply chain partners and use standardized protocols, such as those outlined by CDP.

5.4 Double Counting and Overlap

Double counting occurs when emissions reductions are claimed by multiple entities, leading to inflated or distorted totals. This issue can account for 30–40% of emissions in some portfolios.

Action: Utilize independent third-party audits and adopt standardized methodologies to minimize overlap.

5.5 Overestimation of Benefits

Companies may exaggerate the climate benefits of products or projects by not accounting for full life cycle impacts or through selective reporting.

Action: Comprehensive Life Cycle Assessments (LCAs), following standards such as ISO 14067, help ensure accurate benefit estimation.

5.6 Implications for Carbon Markets

Inaccurate accounting affects carbon credit markets, as issues like additionality, permanence, and double counting undermine market confidence and inflate mitigation costs.

Reference: See Gold Standard for detailed discussions on maintaining offset integrity.

6. Current Trends in Carbon Accounting and Regulatory Compliance

The landscape of carbon accounting is continuously evolving. New technologies and regulatory shifts are driving significant changes in how emissions data is collected, verified, and reported.

6.1 Standards Alignment and Interoperability

Global efforts, spearheaded by organizations like the International Sustainability Standards Board (ISSB), are aimed at harmonizing disparate reporting standards. This will simplify cross-border reporting and enhance data comparability.

Example: The ISSB’s work is expected to bridge gaps between frameworks such as the EU’s CSRD and U.S. SEC disclosures. More details can be found on the ISSB website.

6.2 Convergence of Voluntary and Regulatory Requirements

Voluntary reporting standards are increasingly integrated into mandatory frameworks. For example, the EU Emissions Trading System (EU ETS) now incorporates principles from the GHG Protocol, while California’s cap-and-trade program follows similar guidelines.

Insight: This convergence fosters improved consistency and market trust.

6.3 Focus on Net Zero Goals

Net zero targets are now central to corporate strategies. Initiatives like the Science Based Targets initiative (SBTi) require companies to set short- and long-term goals. Emerging standards such as ISO 14068 are further supporting these ambitions.

Reference: Visit SBTi for guidelines on achieving net zero emissions.

6.4 Enhanced Management of Scope 3 Emissions

Because Scope 3 emissions often dominate an organization’s footprint, improving their measurement is a priority. Collaborative supply chain initiatives and advanced data collection methods are key to this effort.

Insight: Companies that effectively manage Scope 3 can better mitigate supply chain risks and identify efficiency opportunities.

6.5 Technological Innovations in Data Integration

AI, IoT, and blockchain are revolutionizing carbon accounting by enabling real-time data collection and enhanced verification.

Example: Climate Trace employs satellite imagery and AI to provide near-real-time emissions data, supporting more accurate reporting.

Insight: These technologies reduce errors and enable proactive management of emissions.

6.6 Impact on Financial Markets

Accurate GHG reporting is increasingly influential in investment decisions. Transparent, reliable emissions data help investors assess climate risks and drive sustainable investment.

Reference: For further insights, explore articles on ESG Today.

7. Actionable Strategies for Enhanced Compliance and Performance (Including AI-Driven Approaches)

In an increasingly competitive regulatory environment, organizations must adopt innovative strategies to optimize their carbon accounting and compliance efforts. AI-driven solutions offer transformative potential across various dimensions of carbon management.

7.1 Real-Time Data Collection and Monitoring

-

AI-Driven Sensors and IoT Integration:

Implement advanced sensors and IoT devices across facilities to capture real-time emissions data. AI algorithms analyze these data streams to detect anomalies and flag potential inefficiencies.

Example: Climate Trace uses satellite imagery and AI to monitor emissions from industrial sites, providing independent validation of reported data. -

Predictive Maintenance:

AI-powered predictive analytics forecast equipment failures and operational inefficiencies that could lead to increased emissions. This proactive approach helps reduce downtime and minimize emissions.

7.2 Automated Data Integration and Accuracy

-

AI-Based Data Aggregation:

Use machine learning to consolidate data from multiple sources (e.g., utility bills, sensor data, supplier reports) into a unified system. Automated anomaly detection ensures that inconsistencies are flagged and corrected promptly. -

Error Reduction:

AI algorithms continuously refine data inputs by comparing them with historical data, leading to improved accuracy and consistency over time.

7.3 Enhanced Verification and Continuous Auditing

-

AI-Assisted Third-Party Verification:

Integrate AI tools with blockchain technology to create immutable records of emissions data. This facilitates more efficient and transparent third-party audits, reducing the risk of double counting. -

Automated Compliance Reporting:

Develop AI-powered reporting tools that automatically format and submit emissions data to regulatory agencies such as the EPA or the EU ETS, ensuring timely compliance.

7.4 Advanced Scenario Modeling and Forecasting

-

Predictive Scenario Analysis:

Use AI to simulate various emissions reduction scenarios and forecast their impact. This enables organizations to make informed strategic decisions regarding investments in energy efficiency and renewable energy projects. -

Integration with Financial Systems:

AI can link emissions data with financial metrics in ERP systems, supporting integrated planning that balances environmental performance with economic viability.

7.5 Supply Chain Collaboration and Management

-

AI-Powered Supply Chain Analytics:

Deploy machine learning models to analyze and optimize emissions data across the supply chain. This facilitates better management of Scope 3 emissions and improves overall data quality. -

Digital Collaboration Platforms:

Encourage suppliers to use standardized, AI-enabled reporting platforms, enhancing data reliability and enabling seamless integration into the organization’s carbon accounting system.

8. Global Regulatory Nuances and Case Studies

Understanding regional differences in regulatory requirements is crucial for multinational organizations.

8.1 Global Regulatory Comparisons

-

United States:

The US EPA’s GHGRP mandates detailed facility-level reporting. Recent SEC proposals also require public companies to disclose Scope 1 and 2 emissions, with material Scope 3 emissions included when applicable (US EPA, 2022). -

European Union:

The EU’s CSRD and the EU ETS impose strict reporting and verification requirements, driving harmonization across member states (European Commission CSRD). -

Asia:

Countries such as Japan and South Korea have introduced mandatory reporting frameworks that are increasingly aligning with international standards (Japan FSA, 2022).

8.2 Detailed Case Studies

Microsoft

Utilizing AI and cloud analytics, Microsoft has reduced its Scope 1 and 2 emissions by over 30% through continuous monitoring and predictive maintenance. Their data-driven approach, validated by third-party audits, serves as a benchmark for technology-driven sustainability.

Unilever

Unilever’s proactive engagement with suppliers has resulted in significant reductions in Scope 3 emissions. Their comprehensive audit and collaborative strategies have enhanced transparency across their value chain, driving continuous improvements in overall sustainability.

Walmart

Walmart has implemented extensive energy efficiency upgrades and invested in renewable energy, leading to substantial cost savings and lower overall emissions. Their integrated approach across global operations underscores the financial and environmental benefits of robust carbon accounting.

For more in-depth case studies, refer to research published on McKinsey’s Sustainability Insights.

9. Conclusion

Effective carbon accounting is not only critical for regulatory compliance but also for driving operational improvements and fostering sustainable growth. By understanding and implementing robust frameworks—such as the GHG Protocol, ISO 14064, and PAS 2060—organizations can accurately measure their emissions and make informed decisions to reduce their carbon footprint.

As global standards converge and technological innovations, particularly AI, continue to transform data collection and verification, the future of carbon accounting promises greater accuracy, transparency, and actionable insights. For companies looking to lead in sustainability, adopting these best practices is essential for long-term success and competitive advantage.

10. Call-to-Action: Transform Your Carbon Accounting with Cedars Digital

Navigating the complexities of carbon accounting and regulatory compliance is challenging—but you don’t have to do it alone. Cedars Digital leverages cutting-edge AI and digital solutions to streamline data collection, enhance verification, and ensure robust, transparent reporting.

Contact Cedars Digital today to learn how our innovative solutions can empower your organization to achieve superior compliance and performance in the low-carbon economy.

11. References

-

Corporate Finance Institute. (2023). Carbon Accounting. Retrieved from https://corporatefinanceinstitute.com/resources/esg/carbon-accounting/

-

European Commission. (n.d.). Corporate Sustainability Reporting Directive (CSRD). Retrieved from https://ec.europa.eu/info/business-economy-euro/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

-

GHG Protocol. (2023). Greenhouse Gas Protocol. World Resources Institute. Retrieved from https://ghgprotocol.org

-

ISO. (n.d.). ISO 14064: Greenhouse Gas Accounting and Verification. Retrieved from https://www.iso.org/iso-14064-environmental-management.html

-

McKinsey & Company. (2020). Sustainability Insights. Retrieved from https://www.mckinsey.com/industries/sustainability/our-insights

-

Science Based Targets initiative. (2021). Net Zero Corporate Standard. Retrieved from https://www.sbtibc.org

-

TCFD. (2017). Recommendations of the Task Force on Climate-related Financial Disclosures. Retrieved from https://www.fsb-tcfd.org

-

U.S. EPA, OAR. (2022). Greenhouse Gas Reporting Program. Retrieved from https://www.epa.gov/climateleadership/scopes-1-2-and-3-emissions-inventorying-and-guidance

-

Unfccc. (n.d.). Kyoto Protocol. Retrieved from https://unfccc.int/kyoto_protocol

-

Climate Trace. (n.d.). Climate Trace. Retrieved from https://www.climatetrace.org

-

CDP. (2019). Briefing: What are Scope 3 Emissions? Retrieved from https://www.cdp.net/en/articles/media/briefing-what-are-scope-3-emissions